Deep dive: 2025 CAICT Quantum Reports

State of quantum from China's leading government ICT think tank

The CAICT should be a go-to reference for their statistics, technical assessments, and for understanding how Chinese analysts see the state of quantum tech in China and the world. As the leading Chinese government think tank on information technologies and associated with MIIT1 , its conclusions are highly influential in China. In quantum, CAICT is also behind the QIIA (量子信息网络产业联盟), which, to my knowledge, is the largest Chinese quantum industry alliance with 104 member units.

The two CAICT quantum reports published in 2025 include aggregate numbers on Chinese quantum companies and their total funding, comparisons of Western and Chinese quantum cloud platforms, examples of how China deploys quantum sensors, and much more. Some things surprised me, such as the statistic that China has as many companies building quantum computers as the US.

Caveats: While these reports are generally of high quality and I have no reason to distrust their statistics (of which there are a lot), I would caution the reader to keep in mind that such reports are often (deliberately?) incomplete: For example, you will find great aggregate statistics, but limited granular analysis of individual Chinese quantum companies or China’s quantum supply chain. Often, there is more granular detail on Western industry leaders and policy initiatives than on Chinese ones. I can only presume this is due to a combination of factors, including the sensitivity of the topic, Western export controls (to avoid getting anyone targeted), and the target audience and objectives of the report (domestic industry and policy makers, likely aiming to inform them about relevant foreign developments and important strategic gaps). Finally, keep in mind that the reports were published in late 2025; many of the statistics only reflect events up to August 2025.

With that out of the way, what quantum reports did CAICT publish in 2025? I am aware of two reports in late 2025:

Research Report on the Development and Application of Quantum Information Technology (“Quantum Technology Report”, 量子信息技术发展与应用研究报告), dated November 2025. This one has been coming out yearly since 2018.

Research Report on the Development Trends of Quantum Computing (“Quantum Computing Report”, 量子计算发展态势研究报告), dated September 2025, published jointly with QBoson (玻色量子) and a subsidiary of China Mobile (中移(苏州)软件技术有限公司).

In the following, I will go through bits that I found interesting and include machine translations of relevant figures. I recommend having a look at the reports yourself; there is a lot I don’t cover.

Five sections below: International quantum competition, China’s domestic landscape, Quantum Computing, Quantum Communications, Quantum Sensing.

The international quantum competition

US and China “first echelon” and the EU an “important force”

The report refers to the US and China as the “first echelon” (中美处第一梯队) and appears to primarily frame the global competition as a two-horse race between the US and China for overall leadership. Europe is described as “another important force” (另一重要力量) driving the development of the quantum tech industry. Europe is, however, acknowledged as a leader in the total quantity of quantum enterprises and has first-mover advantages in the upstream supply chain.

A lot of facts and figures are provided comparing metrics among different domestic and international regions:

Over 800 global quantum companies, around half in quantum computing …

… out of which 145 are in China, with China’s largest share in quantum communications

In the quantum computing field, China has fewer than half the number of US companies…

According to the Quantum Computing Report, by August 2025, there were over 400 companies in the quantum computing field globally, with 107 in the US and 42 in China.

… but China ties the US in the number of companies that actually build quantum computers

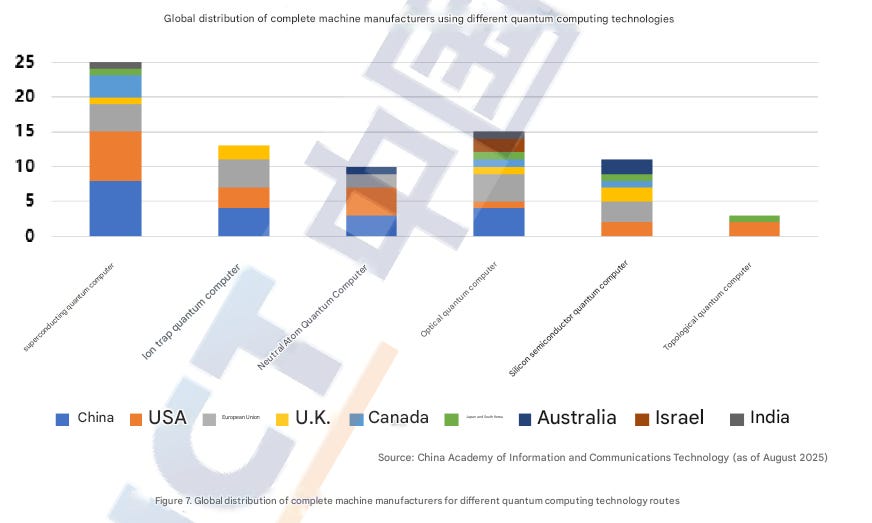

Among these 400+ companies, only over 70 companies actually develop quantum computers globally (the rest are upstream suppliers, software, and algorithm companies, etc.). Interestingly, China matches the US in the number of companies developing quantum computers: Both China and the US account for about 25% each (17-18 companies), with the EU at 22%.

In the figure above, China is absent in silicon and topological quantum computing approaches, which are still mostly pursued in research institutes in China (although Origin Quantum also pursues silicon quantum computing, but I guess they are categorized as superconducting). Compared to the US, China has roughly an equal number of companies developing superconducting quantum computers and leads (in quantity) in trapped ions and especially photonics. At three entries, the number of neutral atoms quantum computing companies seems behind the US, but I am not sure if this tally already includes the recent new Chinese entries to this field.

By simple math, this leaves only fewer than 25 Chinese companies (vs >80 in the US) in other areas of quantum computing that do not build quantum computers themselves. To me, this speaks to the strong vertical integration of some Chinese quantum computing companies, the comparatively smaller focus on quantum computing software, and a still underdeveloped upstream supply chain.

According to the Quantum Technology Report, as of August 2025, there are 12 quantum unicorn companies worldwide, with five in the US (average valuation 4.1 billion USD) and four in China (average valuation 1.4 billion USD). The Chinese unicorns are not mentioned by name, I assume they refer to QuantumCTek (国盾量子), Origin Quantum (本源量子), and CIQTEK (国仪量子), but the fourth one is less clear to me—maybe TuringQ (图灵量子), QBoson (玻色量子), SpinQ (量旋科技), or Huayi Quantum (华翊量子)? By now, they might all be close to unicorn valuation. Canada, Finland, and France each have one quantum unicorn.

Over the past decade, the report claims 1400 investment and financing events in the quantum tech industry, with more than 14.5 billion USD in funding, of which venture capital accounted for nearly 10 billion (the rest being government grants and stock markets?). The United States accounts for around half the funding, the EU for around 2 billion USD, while China saw 1.4 billion USD in quantum enterprise funding. (The Chinese number is very relevant2, I haven’t seen it reported elsewhere, and precise funding numbers for Chinese quantum companies, even for VC funding rounds, are not that easily accessible in my experience.)

Research papers, quantity: China first in quantum communications and measurement, US first in quantum computing and PQC (no combined EU figure)

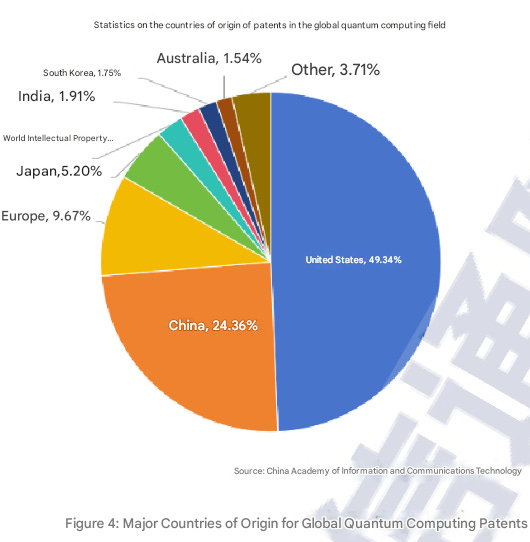

The US dominates Quantum Computing patents, China follows with one-fourth of the global

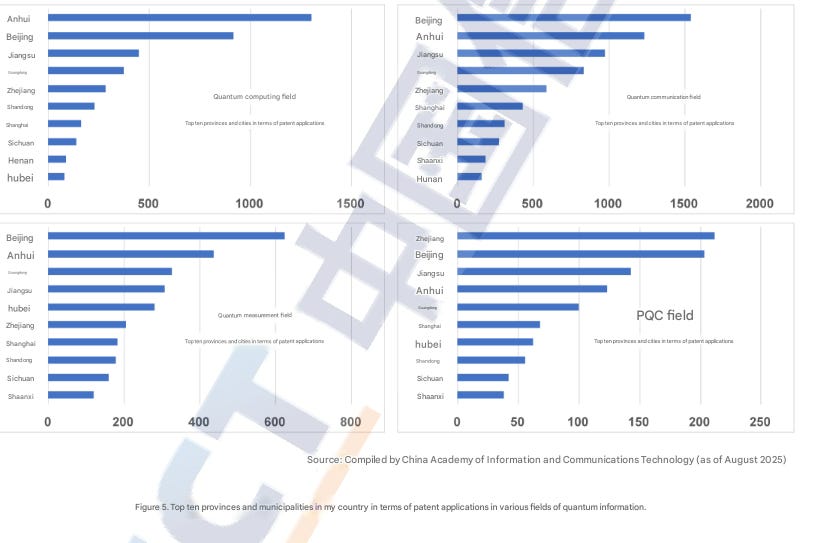

Chinese provinces, by number of patent applications: Anhui (Hefei), Beijing, Jiangsu (Nanjing), Guangdong, Zhejiang (Hangzhou), Hubei (Wuhan), Shanghai …

China’s domestic landscape

The reports include many references to international quantum strategy documents by other countries, and also some references to Chinese policy initiatives. Not much detail is given, but I think it is worth noting what they deem important enough to mention.

Highlighted Chinese national policy initiatives

Future Industry Framing (未来产业): Reference to the 2025 Government Work Report (2025 年政府工作报告), about which I wrote here.

Major Science and Technology Projects (“Megaprojects”, 重大科技项目): I guess this refers to the Sci-Tech Innovation 2030—Quantum Communications and Quantum Computing Major Project (科技创新2030—量子通信与量子计算机重大项目), the national flagship quantum project.

Large Scientific Facility Platforms (大科学设施平台)

The Quantum Technology Report calls to accelerate the cultivation of specialized, refined, and innovative enterprises (专精特新企业), meaning innovative SMEs (small and medium enterprises) in key parts of the supply chain (I always think of this as China trying to replicate a version of Germany’s Mittelstand model).

Standardization: The Quantum Computing Report mentions the MIIT Industrial and Information Technology Standards Work Points (2025 年工业和信息化标准工作要点) and their inclusion of quantum information standards. TC578, the responsible technical committee, approved a few standards, including on quantum computing service platforms, quantum computing benchmarking methods, and ultra-low temperature and noise systems for superconducting quantum computing.

PQC algorithm solicitation: The Quantum Technology Report mentions the February 2025 call by the Commercial Cryptography Standards Institute (商用密码标准研究院) for PQC algorithms.

Public application challenges (jiebang, 揭榜挂帅) by MIIT: They unveil tasks (e.g. “build a dilution refrigerator with specs at least XY”) and invite anyone who can solve them to apply. These challenges have been mirrored at the local level as well. I have talked about this in more detail here.

The Quantum Information Technology and Application Innovation Competition (量子信息技术与应用创新大赛) by QIIA is also mentioned.

Education and talent development

The Quantum Technology Report mentions that 17 universities have established quantum information science undergraduate programs, with USCT, Tsinghua University, Peking University, and Beihang University exploring the establishment of quantum technology colleges and quantum information classes (basically “Elite” programs like the Yao class at Tsinghua, I believe).

Who are the important domestic players?

In the following, direct quotes from the Quantum Technology Report:

“In terms of scientific and technological strength, the Hefei National Laboratory, the Greater Bay Area Quantum Science Center, and the Beijing Academy of Quantum Sciences have become important sources of quantum technology innovation, while China Telecom and China Electronics Technology Group Corporation have driven the construction of the domestic industrial system.”3

“In terms of supply chain security, breakthroughs have been achieved in the localization of key components and equipment such as high-end lasers, high-performance single-photon detectors, dilution refrigerators, electron beam lithography machines, and high-performance time analyzers.”4 — Unfortunately, no concrete names or references here, I assume due to concerns about export controls or sensitivity concerns.

“In terms of science and technology industry clusters, Anhui, Beijing, Shanghai, and the Guangdong-Hong Kong-Macao Greater Bay Area are taking the lead in piloting and actively promoting the development of quantum technology and the layout of future industries, creating quantum technology centers and industrial clusters.”5

The Quantum Computing Report presents the following order: Beijing, Anhui, Guangdong, Shanghai, and Hubei …

… and highlights supportive measures such as local-gov sponsored research projects, future industry funds (未来产业基金), supporting new R&D institutions, constructing public platform facilities (公共平台设施), supporting startups, and providing demand for products and services through public procurement.

In terms of innovations, the Quantum Technology Rerport highlight “the “Zu Chongzhi” superconducting quantum computing prototype [USTC, Pan/Zhu Xiaobo], the “Jiuzhang” optical quantum computing prototype [USTC, Pan/Lu Chaoyang], the “Tianyuan” quantum simulator [USTC, Pan/Chen Yao/Yao Yingcan, ultra-cold atoms], and the “Micius” [USTC, Pan/Peng Chengzhi] quantum science satellite are among the most important achievements in the world, and are at the international leading level.“6 — This is a very Pan-megagroup-heavy list, which, in addition to the technological significance of those, may also tell you something about the political support and narrative power they enjoy…

Let’s look at Quantum Computing, Quantum Communications, and Quantum Sensing separately. Both reports go into quite a bit of technical specs — I mostly limit myself to the high-level takeaways and things that stood out to me.

Quantum Computing

While the Quantum Computing Report describes a critical period of simultaneous development of technology, application, and industry, it also emphasizes that quantum computing is still in early stages with no “winner” yet in the various hardware routes, no “killer apps”, and quantum error correction remaining a key challenge (and hot area of research).

Trends: As for quantum sensing below, convergence with AI is big (e.g. AI helps design quantum chips, quantum computers support AI training). For near-term applications, Quantum-Classical Hybrid Computing (量子-经典混合计算模式) is viewed as the most likely path.

The most prominent Chinese technical quantum computing achievements in 2025:

Zuchongzhi No. 3 (祖冲之三号), USTC: Superconducting, 105 qubits with single/two-qubit gate and readout fidelities reaching 99.90%, 99.62%, and 99.18% respectively, random circuit sampling task. (I don’t think the below-threshold error correction experiment by the same group is included in the report.)

Tianmu No. 2 (天目 2 号), Zhejiang University: 100-qubit superconducting quantum chip, demonstrated topological edge states.

USTC: Two-dimensional atomic array of 2024 atoms (was big in the news at the time as a “world record”).

Peking University: Cluster state generation in optical quantum chips (基于集成光量子芯片的连续变量簇态量子纠缠).

QBoson (玻色量子): 1000-qubit optical quantum coherent Ising machine (1000 量子比特光量子相干伊辛机). Note: They are one of the report’s co-authors.

Shanghai Institute of Microsystem and Information Technology (SIMIT, 上海微系统所): Entanglement receiver chip (纠缠接收芯片)

(Jiuzhang 4 (九章4号), USTC, is not mentioned)

You can find a lot more details on technical developments, companies, and quantum computing applications in the report. Note that while some of the prominent Chinese quantum computing companies are mentioned, there is no comprehensive overview of the Chinese quantum computing enterprise ecosystem (there is one for Europe & North America, though…).

The importance of Benchmarking is highlighted repeatedly in the Quantum Computing Report. In this vein, CAICT launched a second version of a Quantum Computing Evaluation System (量子计算测评体系 2.0).7 This evaluation covers hardware, measurement & control, compilation tools, algorithms, cloud platforms, and application software. Out of these, I want to talk in more detail about quantum computing clouds.

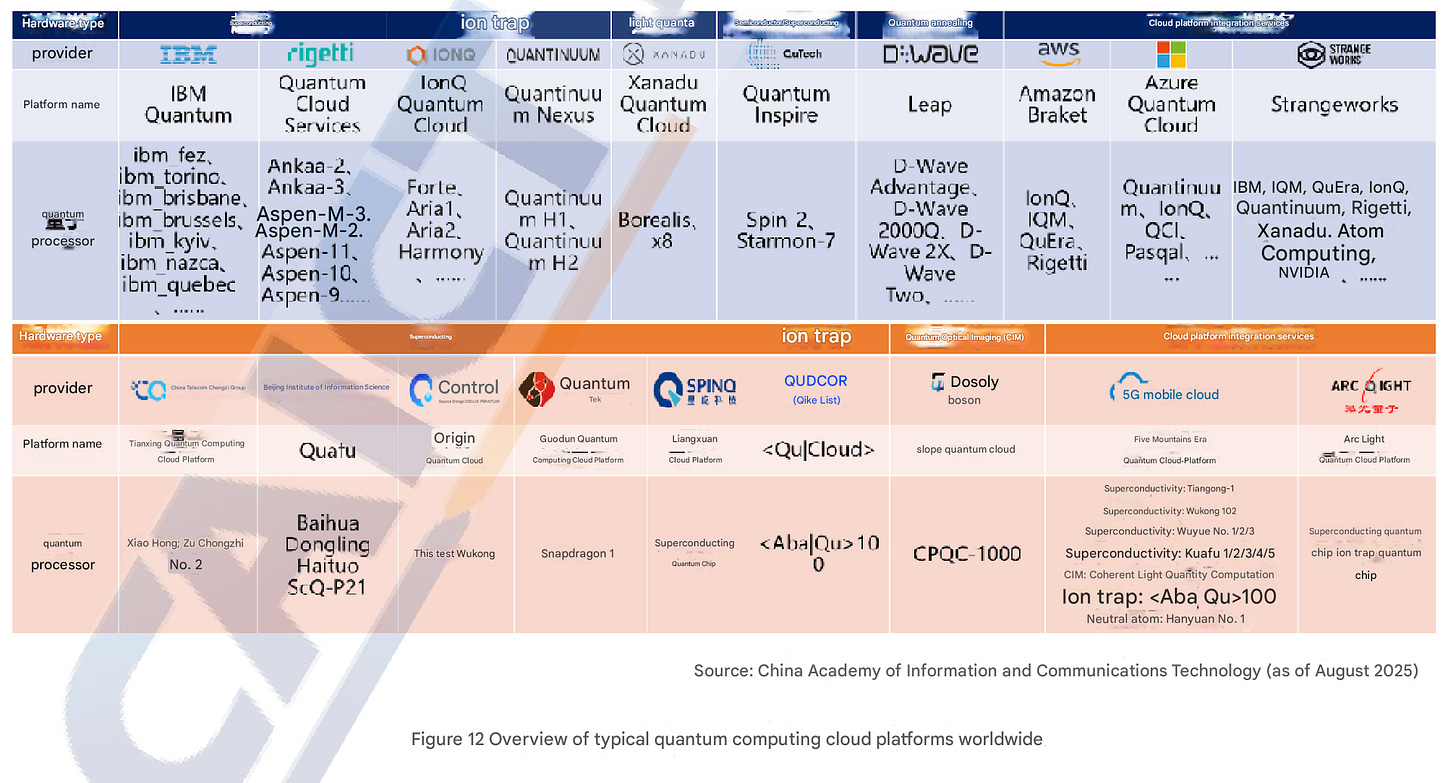

Comparison of quantum computing cloud platforms

Quantum computing cloud platforms are described as crucial infrastructure supporting commercialization and industrial development. In my view, the Chinese quantum cloud players at the bottom of the figure still significantly lag their Western counterparts (indeed, the Quantum Technology Report highlights this area as something to be improved in China). However, as I mentioned in my piece on China’s quantum industrialization, I expect this gap to close going forward, and I think this area will be interesting to watch.

For better readability, here is the second half of the figure above as a bullet list:

China Mobile (中国移动): Wuyue Jiyuan Quantum Cloud Platform (五岳纪元量子云平台)

Devices:

Superconducting: Tiangong No. 1 (天工 1 号), Wukong 102 (悟空 102), Wuyue No. 1/2/3 (五岳 1/2/3 号), Quafu No. 1/2/3/4/5 (夸父1/2/3/4/5号) — Wukong is from Origin Quantum (本源量子) and Quafu from BAQIS (see below); as for Tiangong, I am not sure, I thought that was one of QBoson’s earlier devices (which wouldn’t make sense as it is categorized as superconducting).

CIM (Coherent Ising Machine): Coherent Optical Quantum Computer (相干光量子计算机), from QBoson (玻色量子)

Ion Trap: <Aba|Qu>100, from QuDoor / Qike Quantum (启科量子)

Neutral Atom: Hanyuan No. 1 (汉原 1 号)

Based on this figure, China Mobile has onboarded quite a lot of systems (and they reportedly also have a trapped Ion device from Huayi now), yet I couldn’t find a public-facing cloud platform last time I checked.

Note: China Mobile is one of the report’s co-authors.

China Telecom (中国电信): Tianyan Quantum Computing Cloud Platform (天衍量子计算云平台)

Superconducting: Xiaohong (骁鸿), Zu Chongzhi No. 2 (祖冲之 2 号), from QuantumCTek (国盾量子)

In the meantime, the Zu Chongzhi No. 3 chip has reportedly also been onboarded by China Telecom.

Beijing Academy of Quantum Information Sciences (BAQIS, 北京量子信息科学研究院): Quafu (夸父量子计算云平台)

Superconducting: Baihua, Dongling, Haituo, ScQ-P21

Bose Quantum (玻色量子): Bose Quantum Cloud (玻色量子云)

CIM: CPQC-1000

Origin Quantum (本源量子): Origin Quantum Cloud (本源量子云)

Superconducting: Origin Wukong (本源悟空)

QuantumCTek (国盾量子): QuantumCTek Computing Cloud Platform (国盾量子计算云平台)

Superconducting: Xiaohong 1 (骁鸿 1 号)

QuDoor / Qike Quantum (启科量子): <Qu|Cloud>

Ion Trap: <Aba|Qu>100

SpinQ (量旋科技): SpinQ Cloud Platform (量旋云平台)

Superconducting (no specific model given)

Arc Light Quantum (弧光量子): Arc Light Quantum Cloud Platform (弧光量子云平台):

Superconducting and ion trap chips (no specific model given)

(The rest of this post is fully based on the Quantum Technology Report)

Quantum Communications

Quantum secure communication (QKD+QRNG) is described as in a stage of preliminary utility (初步实用化):

In terms of technical directions, the report notes that twin-field (TF-QKD) and mode-pairing QKD (MP-QKD) protocols are active areas of development and that space-to-ground QKD has become a hot topic (with China maintaining its lead, I discussed this more here).

In terms of deployment, the report distinguishes between online (tightly coupled, 紧耦合) and offline (loosely coupled, 松耦合) QKD+QRNG solutions. The former, referring to the deployment of QKD devices directly with the encryption equipment, is very expensive and inflexible but highly secure. The latter involves an intermediate key management layer (think dedicated China Mobile SIM cards that contain QKD keys); this is cheaper and more flexible, but with a “last mile delivery” problem.

The report highlights a few application examples, such as such as China Telecom Quantum partnering with Huawei to complete a 2000 km quantum-secure OTN (optical transport network) link between Hefei and Inner Mongolia; Nanjing University and USTC demonstrating drone-to-ground QKD; China Telecom Quantum developing a "Quantum Safe Gas Station Tax Control System" (量子安全加油站税控系统) to manage oil retail data; China Mobile launching the "Zhongyi Mixun" (中移密讯) service using Super SIM cards for encrypted office communication; State Grid (国家电网) using QKD for encryption in its "220kV Hefei Houdian Quantum Application Demonstration Substation" (220千伏合肥候店量子应用示范变电站); and USTC using the "Jinan No. 1" (济南一号) micro-nano satellite to achieve intercontinental quantum key distribution.

Quantum Key Distribution (QKD) vs Post Quantum Cryptography (PQC) in 2025

[Disclaimer: My job is in the field of QKD, so I may have a slight conflict of interest here.]

It is a common (increasingly less applicable) narrative that China went all in on QKD while the US went the opposite direction, with a strong focus on PQC. In this context, it is interesting that the Quantum Technology Report is quite frank about the challenges of QKD: Lacking performance indicators (key generation rate, transmission distances), high costs and infrastructure requirements, difficulties in managing trusted relays, and intensifying competition with the PQC industry.

The report notes that as US (NIST) PQC standards set industry trends, China’s own PQC standardization is accelerating and poses a commercial threat for QKD: PQC is currently much cheaper, easier to integrate, end-to-end, and (once domestic standards are finalized) meets compliance requirements. Therefore (according to the report), for most scenarios, QKD is not necessary. In addition, “whether and how the PQC+QKD integrated encryption scheme can achieve a synergistic effect (1+1>2) requires further exploration by the industry.”8

I compared this to some of the older CAICT reports from prior years. Back in 2022 and 2023, PQC+QKD fusion was emphasized. The two technologies were described as complementary (defense-in-depth). The 2024 report then marks a bit of a narrative shift: In the period of the 2024 report, European cyber agencies issued critical position papers on QKD, which were referenced in the CAICT report, noting that “problems and controversies still exist.” Finally, the 2025 report clearly positions PQC as the primary solution, with fast migration a priority and fusion with QKD (for most) optional. (No specific quantum-safe transition timeline is mentioned for China.)

With all this QKD criticism, let it also be said that the report does highlight positive developments in the QKD field, such as the application examples mentioned above and breakthroughs in miniaturization (e.g. chip-based QKD at BAQIS, the Beijing Academy of Quantum Information Sciences). Furthermore, for specific high-security private network scenarios, the information-theoretic security of QKD remains a unique technical advantage. This is recognized as a means to further strengthen security beyond PQC alone and mitigate concerns about the long-term future resilience of PQC algorithms.

Quantum Sensing

As the figure below demonstrates, there are a lot of different quantum sensing technologies, making overarching statements about the field as a whole difficult.

In terms of maturity, the report highlights atomic clocks as highly mature and commercial (with research on next-generation optical atomic clocks booming). Following this are quantum radar/lidar, gravimeters, and magnetometers. Quantum gyroscopes and Rydberg antennas on the least mature end are still climbing the peak of inflated expectations, according to the 2025 Quantum Technology Report.

In terms of big picture trends, the report notes convergence with AI (AI for optimizing control parameters and processing noisy output data) and applications in critical infrastructure, resource exploration, and biomedicine.

The Quantum Technology Report dives quite deeply into some of the quantum sensing verticals (especially clocks). For this post, let’s end it with some examples of Chinese technical breakthroughs and applications mentioned in the report.

Chinese quantum sensing applications in 2025

Pipelines: The National Pipe Network Group Research Institute (国家管网集团研究总院) applied quantum magnetometers for pipeline micro-defect detection.

Resource exploration: The MCC Wukan Quantum Prospecting Research Institute (中冶武勘量子探矿研究院) conducted mineral exploration using Quantum Gravity Meters (量子重力仪) and Drone-borne Cesium Atom Optical Pump Magnetometers (无人机搭载的铯原子光泵磁力计).

Quantum Lidar for environmental monitoring: Guoyao Quantum (国耀量子) deployed a "Particulate Matter Optical Quantum Lidar Environmental Monitoring Network" (颗粒物光量子雷达环保监测网络).

Power Grid: In what seems to be a major demonstration project, State Grid (国家电网) put the "220kV Hefei Houdian Quantum Application Demonstration Substation" (220千伏合肥候店量子应用示范变电站) into operation with 18 types and 85 sets of quantum equipment, including:

Quantum Current Transformers (量子电流互感器): Measuring magnetic fields utilizing nitrogen-vacancy (NV) center-based technology. Application advantage: High precision.

Quantum Non-destructive Flaw Detectors (量子无损探伤仪): Measuring magnetic fields utilizing the tunnel magnetoresistance (TMR) effect. Application advantage: High efficiency.

Quantum Distribution Network Current Sensors (量子配网电流传感器): Measuring magnetic fields utilizing the tunnel magnetoresistance (TMR) effect. Application advantage: High flexibility.

Integrated Quantum DC Energy Meters (一体式量子直流电能表): Measuring magnetic fields utilizing the tunnel magnetoresistance (TMR) effect. Application advantage: High integration (高集成度).

Quantum Dot Fire Sensors (量子点火灾传感器): Measuring gases utilizing quantum dot MEMS technology. Application advantage: Extremely early warning.

Quantum Dot Multi-parameter Sensors (量子点多参量传感器): Measuring multiple gas parameters utilizing quantum dot MEMS technology. Application advantage: Multi-parameter online monitoring.

Optical Quantum Radar (光量子雷达): Measuring signals utilizing single-photon detection technology. Application advantage: High sensitivity.

Quantum Time Synchronization Devices (量子时间同步装置): Synchronizing time utilizing integrated space-ground quantum time synchronization technology. Application advantage: High stability.

Quantum Attitude* Sensors (量子姿态传感器): Measuring magnetic fields utilizing the tunnel magnetoresistance (TMR) effect. Application advantage: High precision. *Apparently, “attitude” refers to the orientation of an object in 3D space.

Chinese quantum sensing technical breakthroughs in 2025

Strontium Optical Lattice Clock, CAS National Time Service Center: Achieved a systematic uncertainty of 1.96×10^−18, making China the second country (after the US) in the world to break the 2×10^−18 threshold.

Ultra-Sensitive Inert Gas Detector, USTC: Utilized an inert gas nuclear spin system to amplify magnetic field signals by 145 times, achieving ultra-high sensitivity detection of weak magnetic fields with optimal filtering.

Spin Squeezed Magnetometry, Fudan University: Achieved steady-state atomic spin squeezed states and used machine learning to reach a continuous measurement sensitivity surpassing the standard quantum limit.

Space Cold Atom Interferometry, CAS Precision Measurement Institute: Conducted atomic cooling and interferometry experiments inside the “Tiangong” Space Station (Tianhe Core Module, 天和核心舱), achieving quantum inertial rotational measurement under microgravity conditions.

MIIT stands for the Ministry of Industry and Information Technology (中华人民共和国工业和信息化部), which appears to play an active role in China’s push for the industrialization of quantum tech (quantum innovation challenges, application scenarios, pilot production platforms, …).

Hence the exact quote: 从地区分布看,美国企业 和市场投融资活跃度最高,全球占比约 50%,欧盟量子企业融资超 20 亿美元,我国约为 14 亿美元。

科技力量方面,合肥国家实验室、大湾区量子科学中心、北京量子 院等成为量子科技创新的重要策源地,中国电信、中国电科等带动 国内产业体系建设。

供应链保障方面,高端 激光器、高性能单光子探测器、稀释制冷机、电子束曝光机、高性 能时间分析仪等重要器件装备实现国产化突破。

科技产业集群方面, 安徽、北京、上海、粤港澳大湾区等地方先行先试,积极推动量子 科技发展与未来产业布局,打造量子科技中心与产业聚集地。

创新成果方面,“祖冲之号”超导量子计算原型 机、“九章”光量子计算原型机、“天元”量子模拟器、“墨子号”量 子科学卫星等重要成果处于国际领先水平.

PQC+QKD 融合加密方案能否以及如何实现 1+1>2 优势,也需要业界进一步探索。