How China plans to turn quantum into a future industry

Big picture views on the transition happening in China's quantum ecosystem

The dominant “Western narrative” (1, 2, 3) of an insular, state-planned and state-lab dominated Chinese quantum ecosystem without meaningful private sector competition, is rapidly becoming obsolete.

In this piece, I want to talk about the big picture of China’s quantum sector and government strategy. I will share predictions on the high-level transition that is taking shape in China’s quantum sector and discuss interesting, largely unreported (in English-language media) recent developments. Admittedly, some of these predictions are preliminary and speculative; feedback and push-back are very much welcome.

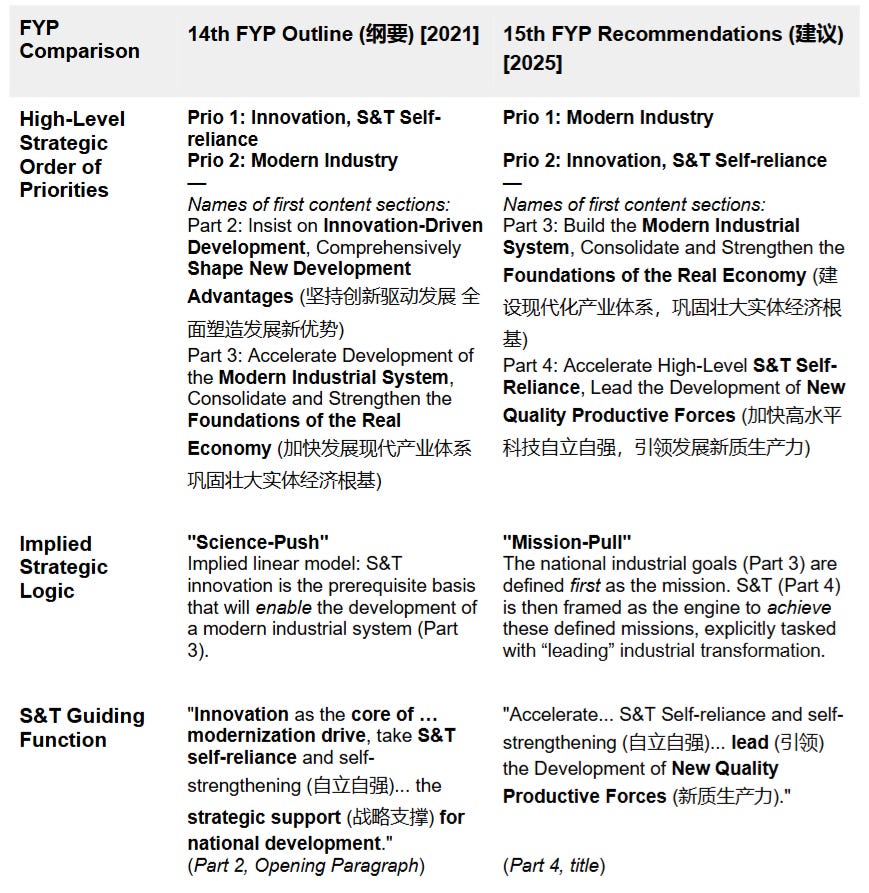

Before the 2020s, the primary objective in Chinese policy documents was to build the scientific and technological foundation (the “National Strategic S&T Forces”) for future leadership in quantum information technologies. The policy tools of that era were talent plans, national laboratories, and fast-growing research funding. This period was accompanied by significant reorganization that continued well into the 14th five-year plan (FYP14, 2021-2025), but appears largely completed in the quantum sector and is giving way to a new number one priority: Industrialization.

Already since the 2020s, Chinese policy documents have increasingly talked about the application and industrialization of quantum technologies. China is now walking the talk.

In 2025, cultivating companies, applications, and markets are becoming the new number one priority for quantum technology, elevated above even foundational technological breakthroughs such as quantum satellites or quantum advantage computations. The strategic logic transitions from a linear “Science-Push” model to a mission-driven pull from the quest for New Quality Productive Forces (NQPF)1.

The quantum S&T policy tools of the pre-2020 era were successfully established and reorganized; they are now joined by quantum industrial policies such as dedicated Government Guidance Funds (GGF), quantum tech parks and incubators, “bounty” competitions (揭榜挂帅), and the entry at scale by some of China’s biggest SOEs.

The implications are significant and, given the successful marginalization of China’s quantum business sector during the Biden administration, may surprise many Western quantum professionals: Expect Chinese quantum exports slowly working their way from upstream components to downstream end user platforms, expect more international partnerships announcements, especially with BRI countries, and, ironically for many, expect a China that appears internationally increasingly open while Europe and the US are closing doors.

Apologies for the lack of posts in recent months. Your author has been exceedingly busy with other projects. Planning to find a healthy cadence of China∩Quantum Briefs, but in lack of time this combines an update on recent developments and some broader analysis.

This piece is structured as follows:

A new framing: Contrasting the recent five-year plan recommendations with FYP14, I discuss what has evolved in the high-level priorities of the Chinese government and its framing of quantum technologies.

Quantum as the #1 Future Industry and what this means in practice: I discuss concrete policies in Hefei, the heartland of China’s quantum ecosystem, and what this means for concrete applications in quantum computing, communication, and sensing.

Export controls and self-reliance revisited: The discussion wouldn’t be complete without discussing Western export controls and China’s self-sufficiency efforts.

What does all this mean internationally?

1) The transition: From building the foundations to laying out future industries

The Party’s recommendations for the 15th Five-Year Plan

The CPC Central Committee recently issued recommendations for the 15th Five-Year Plan (FYP15 recommendations). Unsurprisingly, Science and Technology Innovation (S&TI), self-reliance, and industrial modernization play prominent roles in FYP15. On a high level, the priorities are:

Industrial Modernization

Innovation, S&T self-reliance

Consumption and Domestic Demand

High-level socialist market

Opening up

… other priorities.

For quantum, we care about 1. and 2., the top two priorities (order matters here). In comparison to FYP14, this puts industrial modernization from the second to the top spot, changing places with innovation and S&T self-reliance.2

In quantum, this “swap” absolutely agrees with the shift in strategic logic I am observing: From a linear “Science-push” perspective — build up the underlying technological capabilities, then build a modern economy on top of this basis — to a “Mission-Pull” approach — starting from industrial goals and scenarios, leverage S&T as the engine to achieve these goals and lead NQPF.

The FYP15 recommendations are much lighter on detail than the full FYP15 will be, and quantum is only explicitly mentioned once — as a future industry in the section on industrial modernization.

Maybe the most overused phrase in the quantum field is that “quantum is moving from the lab into real-world applications.” Is the quantum future industry framing just a rehash with Chinese characteristics?

Partly — China’s Quantum Information Association (QIAC) phrases the focus on applications as follows: “Quantum technology is moving from the ‘future’ to the ‘present.’ It is no longer just a theoretical exploration in the laboratory, but an important direction for new productive forces, becoming a key force driving industrial upgrading and technological innovation.”

All this sounds quite vague and hypey, but there is more differentiation3 to it. Below, we will dive into detail about how this transition is to be brought about by Chinese policies and how it might look in quantum computing, quantum communications, and quantum sensing.

Future Industries: Quantum tech becomes number one

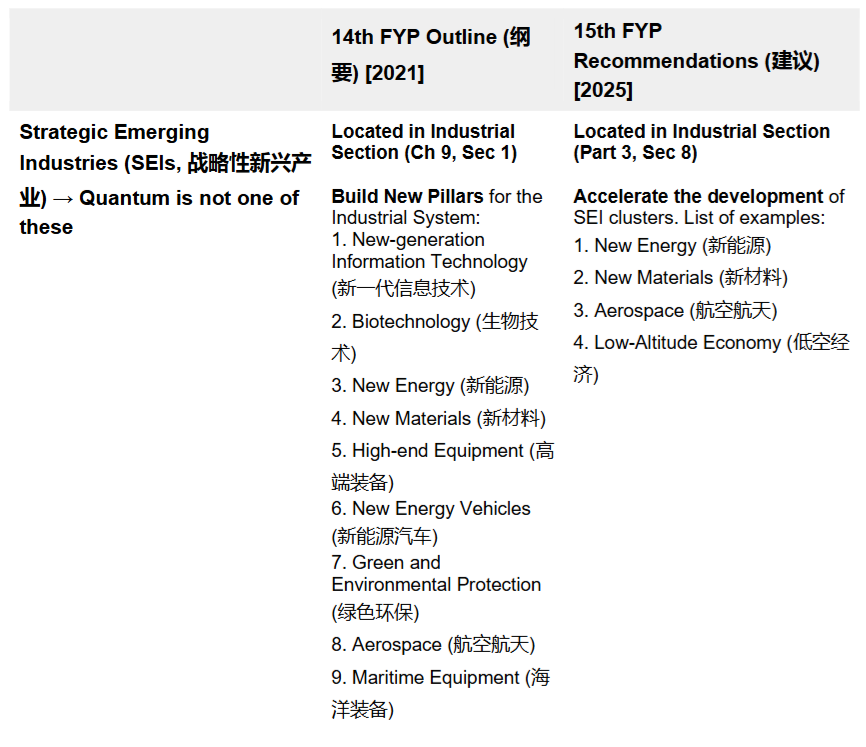

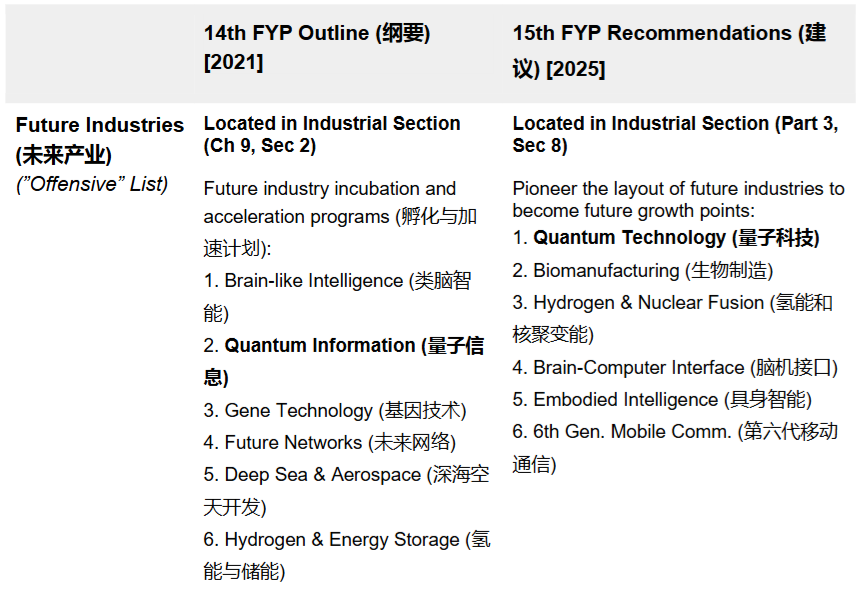

Already in FYP14, quantum was listed second among the future industries; now it has moved to the number one spot4, followed by biomanufacturing and hydrogen & nuclear fusion.

Beyond quantum moving up to the top spot (again: order matters here), compared to FYP14, the framing has shifted from merely accelerating and incubating these future industries towards actively shaping their future layout and identifying areas where they can contribute to economic growth.

This list of future industries are the “offensive list” in China’s industrial modernization strategy: With no entrenched technological paradigm dominated by Western companies and with China at the “same starting line” as traditional developed countries, these fields, tomorrow’s strategic emerging industries, provide an opportunity for China “overtake in the corner” (弯道超车) and reshape the global value chain.

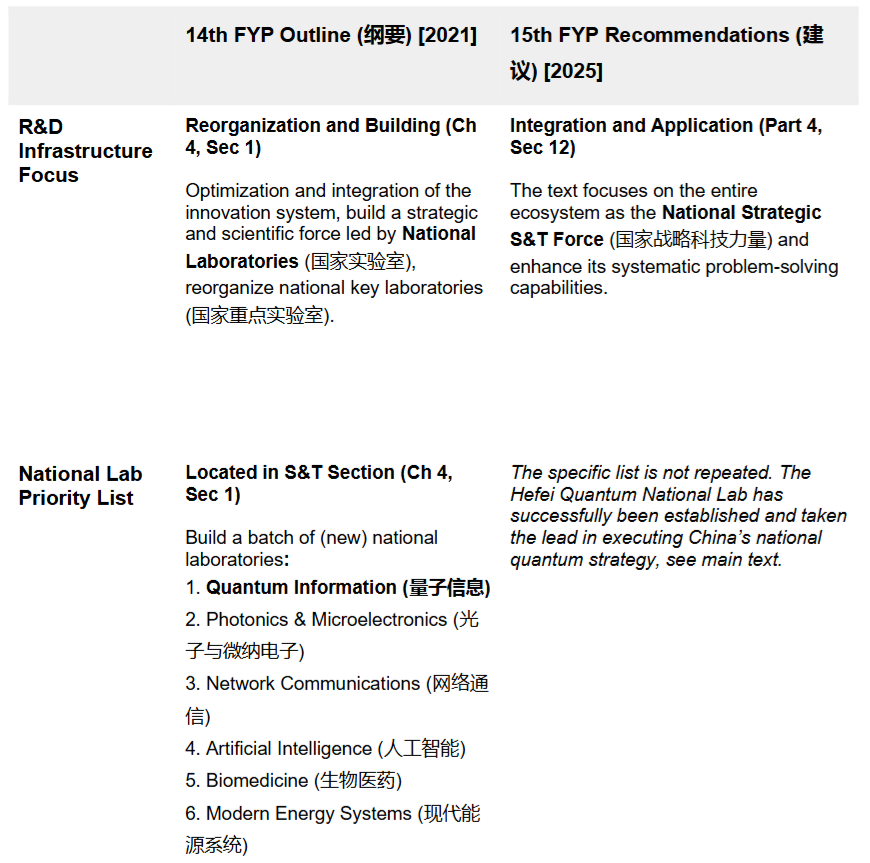

The foundation: National Strategic S&T Forces

During FYP14, the reorganization and construction of China’s National Strategic S&T Forces were central to the innovation section of the FYP. What followed was the establishment of the Central Science and Technology Commission (CSTC) in 2023, a comprehensive reorganization of State Key Laboratories (SKL, 国家重点实验室) and the construction of a new generation of National Laboratories (国家实验室). Beyond just being the highest-level national research institutions, these (new) national labs are to lead the overall innovation system and achievement of national tasks.

Among the list of six areas for national lab construction in FYP14, quantum information was the first. Indeed, while I am not very familiar with the other five fields, I wouldn’t be surprised if the quantum national lab is the first that has been completed out of this new generation of national labs. The Hefei National Quantum Lab began its construction already in 2017 and became fully operational during FYP14. Besides being a sprawling research facility, it manages the Sci-Tech Innovation 2030 Quantum megaproject (科技创新2030—量子通信与量子计算机重大项目), China’s flagship national quantum research megaproject.5 The Sci-Tech Innovation 2030 Quantum megaproject was announced in 2016, and although it does include quantum technology applications, I would firmly put it into the “old #1” priority area of strengthening scientific and technological foundations.6

With the reorganization of the S&T ecosystem (at least for quantum) largely completed, the FYP15 recommendations aim to leverage the National S&T Forces for breakthroughs in key core technologies (self-reliance) and to lead the road to New Quality Productive Forces.7

The new top priority

In recent years, the emphasis on the “Future Industry” designation — introduced by Xi in 2020 — of quantum technologies has taken increased prominence.

This framing puts the mission, industrial modernization, into the centre and introduces a range of industrial policy tools into the quantum sector: Government Guided Funds (GGF), quantum tech parks and incubators, “bounty” competitions (揭榜挂帅), and the active involvement of SOEs.

By no means do these new measures replace government labs, basic science funding, and talent plans. Rather, new quantum industrial policies reorient the National S&T Forces towards the mission of industrial modernization and, with it, expand an area of the Chinese quantum ecosystem that has long been lagging behind the West.

When I came to China in 2023, the impression I had was that the private Chinese quantum sector was tiny, and most of the funding and talent were instead concentrated in research institutions. Start-ups, where they existed, were relatively low-profile, hustling away at building cool stuff, but very barebones, without the marketing and PR teams of Western start-ups (some possibly also keeping a low profile to avoid joining the Chinese quantum companies on the US entity list). More importantly, there didn’t seem to be meaningful Chinese user communities or well-maintained open-source software products. Where are all the software and quantum algorithm companies, where are the consulting businesses promising that quantum will change the world — and that *you need them* to make you quantum-ready? Where are the quantum cloud platforms and SDKs, the Chinese Qiskit and Pennylane? Where are the student hackathons, where is the Chinese Quantum x Society / responsible quantum (ResQT) community?

I still haven’t found the Chinese ResQT community (Please reach out if you know!), and I would expect pure play quantum consulting or algorithm companies to continue lagging the West. But on all the other points, I believe that things are rapidly changing. Quantum technology is declared to be the number one future industry, and with it comes a focus on building applications and application platforms by deploying China’s well-honed set (plus quite a few new ones) of industrial policy tools.

Let’s dive deeper into the logic and policy tools through which the Chinese government aims to shape the future layout of the quantum industry and identify economically meaningful applications.

2) Quantum as a future industry, in practice

Both local government R&D funding, accounting for around ⅔ of fiscal S&T expenditures, and economic competition among provinces (“local state corporatism”) are defining features of China’s innovation ecosystem. Therefore, to understand how the Future Industry designation is put into practice, Anhui province and its city of Hefei, China’s “quantum capital,” are an instructive place to start.

Thousands of quantum applications

Anhui province’s “Quantum Information ‘Thousand Scenarios’ Action” (量子信息“千家场景”行动) is probably the most ambitious local government action plan to identify quantum applications in the economy.

Led by the local DRC (Development and Reform Commission), it aims to cultivate 300 quantum application scenarios by the end of 2025, 1,000 by the end of 2027, and over 3,000 by 2030. For quantum, these are really big numbers.

It is one of the first local implementations of a new, wider national initiative8 to promote the large-scale application of technology (beyond quantum) in new scenarios.

How are they planning to achieve this? By heavily leveraging state-owned enterprises (SOEs). These SOEs and other enterprises (demand side) are encouraged to trial, and eventually operate and scale, quantum applications provided by the large ecosystems of research institutes and quantum startups in Hefei (supply side; Hefei’s quantum industrial chain is now said to encompass nearly 100 companies — the usual caveats apply). The local government plays the role of a matchmaker between supply and demand. Successful model scenarios are then publicized as benchmarks.

In addition to matchmaking meetings, the local government organizes challenges where bottlenecks or industry needs submitted by enterprises (posting unit) are publicized as competitive challenges9. Other enterprises, or research institutes (solving unit), can then apply to solve the challenge, with consortia encouraged as long as they have no relationship to the issuing unit.

Examples of such challenges posted in Anhui in 2025 include the development of low-temperature electronics for superconducting quantum computers and the development of a measurement and control system for error correction on ion trap quantum computers.

It seems that most of the funding will be provided by the SOEs and other enterprises on the demand side, although the local government provides subsidies. Furthermore, in many cases, the government will be the eventual end user, such as in the case of the Hefei City QKD network. Here, the government funding for operation and maintenance is adjusted based on an annual project assessment that includes KPIs related to how successful the project is in spurring wider industrial development.

The government also aims to provide the necessary infrastructure for turning research prototypes into mass-producible products. A recent central government notice10 calls on local governments to establish “pilot-scale platforms in manufacturing,” with quantum technologies one of a few priority areas.11 These platforms are to provide verification services, physical infrastructure — such as, for quantum, expensive high-power dilution refrigerators, ultra-stable lasers, or electron beam lithography machines — and trial-production lines.

No doubt, all this ambition, the huge number of planned quantum applications should be taken with a grain of salt, with waste and largely useless quantum marketing stunts to come. But I would be surprised if none of these thousand trials hit something that works.

Before we look at what this means specifically for quantum computing, quantum communications, and quantum sensing, let’s try to understand how Chinese planners prioritize different quantum application scenarios.

Which technologies are ready for application?

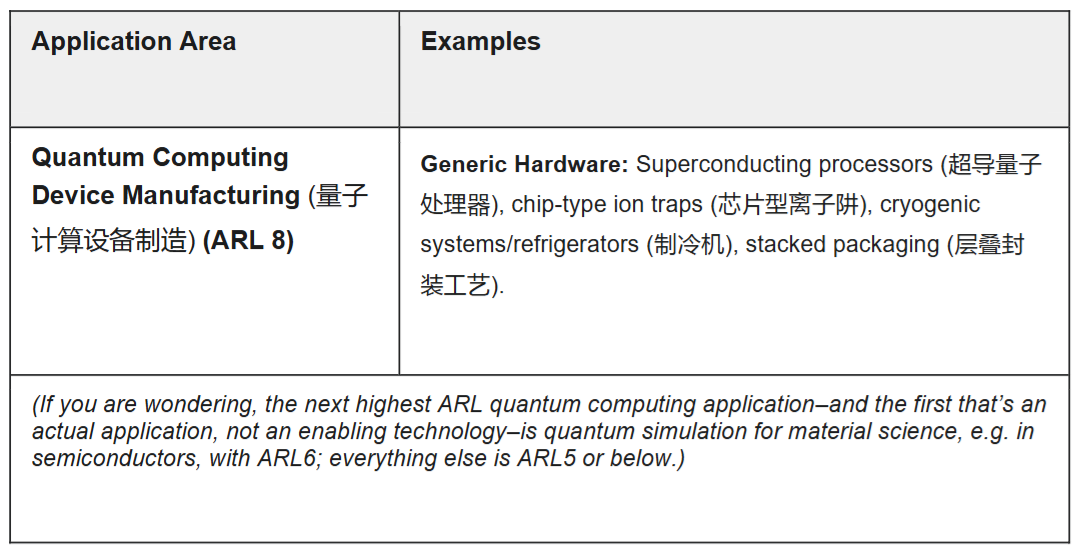

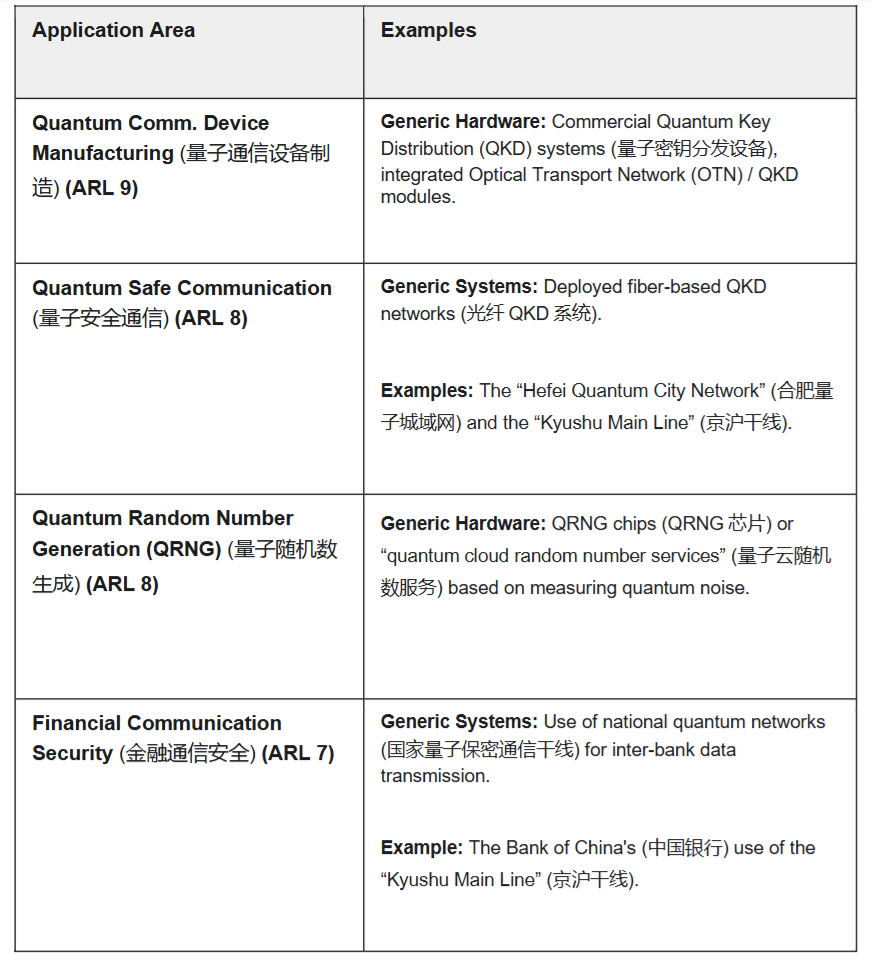

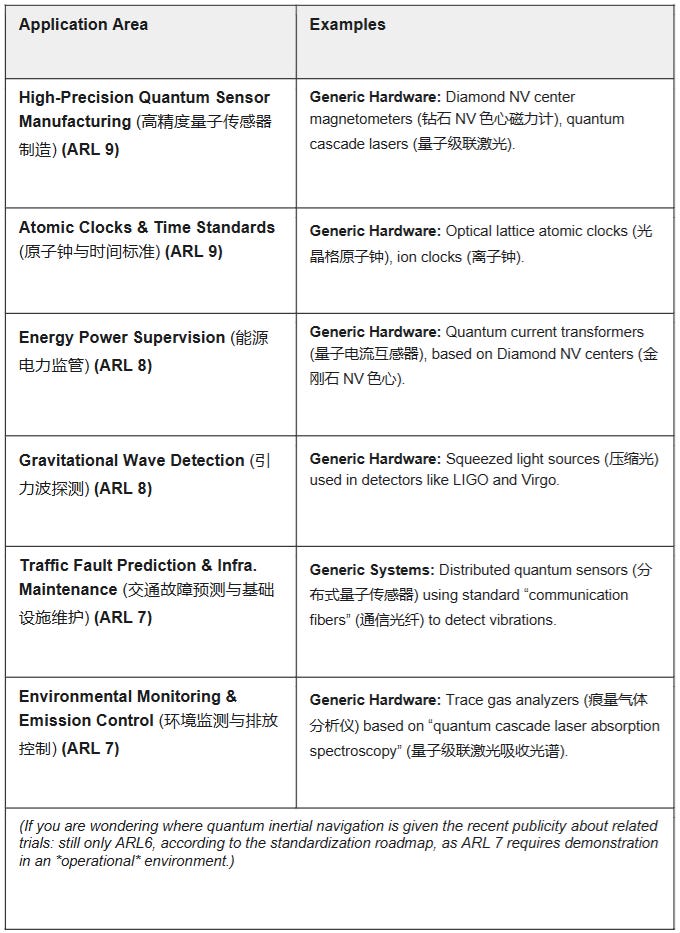

The recently published Chinese roadmap for the standardization of quantum information technology applications12 provides an excellent framework for answering this question. It introduces a scoring called “Application Readiness Level” (ARL) that combines technological readiness (TRL) with application matching/fit and business viability.

A given quantum technology is then identified for urgent standardization if it is of high application readiness with little existing standardization. Simple as that. Of course, national policy priorities and international opportunities to take the lead can adjust the prioritization as needed.

The excellent roadmap provides an explicit list of quantum application scenarios and their respective estimated ARL. In the following tables, we highlight the most mature ones, with ARL 7-9 (9 being the highest). These are the applications we should be thinking of when discussing how China’s pivot to quantum industrialization plays out in practice in quantum computing, quantum communications, and quantum sensing.

Industrialization in Quantum Computing

Quantum Computing is the least application-mature among the three areas of quantum information technology. Unsurprisingly, only one high-ARL application is mentioned in the standardization roadmap, and that one kind of cheats: The manufacturing of quantum computers themselves and their components.

Despite this lack of high-ARL applications, I believe there are other things to look out for in the impact of China’s industrialization drive on quantum computing: Cloud platforms and open source software communities.

To date, China seems to be trailing the West in competitive cloud platforms through which quantum computers can be accessed remotely. Ditto (mostly) for associated open source software communities and user bases.

I believe that the time of China not having serious and professional quantum cloud platforms is about to be over. In addition to the larger quantum start-ups themselves (QuantumCTek, Origin Quantum, QBoson, …), the big ones to watch here are the telecom SOEs.

China Telecom has established its own quantum subsidiary in Hefei, with a controlling stake in QuantumCTek and more than CNY 10 billion of planned investments over the coming years. Besides significant business in QKD, China Telecom launched its own quantum cloud platform (Tianyan, 天衍). For now, it only features QuantumTek’s superconducting quantum computers, but I would expect that they will eventually onboard other partners. China Mobile also launched its own platform (Wuyue, 五岳), intentionally hardware-agnostic; they have onboarded photonic (QBoson) and trapped ion (from Huayi Quantum) platforms and are planning for neutral atoms.

To build a quantum computing talent and user base, I have come across a variety of large Chinese quantum computing hackathons (e.g., CCF “Sinan Cup” (司南杯), China Mobile “Wuyue Cup” (五岳杯), MindSpore), some with quite general prize budgets. In addition to building user and developer communities, these hackathons are also increasingly leveraged to solve challenges posted by enterprises or to develop promising quantum applications13.

Industrialization in Quantum Communications

Quantum Key Distribution (QKD) is significantly more mature than quantum computing. While implementation-specific performance and security standards are still lacking, the application (not just the manufacturing) of fiber-based QKD already scores 8 out of 9 in application readiness according to the Chinese standardization roadmap.

It is well-known that China is many years ahead of the rest of the world in the actual deployment of QKD networks for the transition to quantum-safe cryptography, with over 12,000 km of QKD backbone network and at least 16 local area networks. The Hefei local area network alone has over 150 nodes and 1’000km of QKD fiber links, larger than most national networks.

Here too, China Telecom is one of the important SOEs to watch, as it markets various QKD (and PQC)-secured endproducts such as distributing QKD keys to phones through SIM cards (claiming to serve over 5 million users) or a QKD-secured cloud service.

Furthermore, one major achievement of FYP15 will likely be progress in integrating land-based and space-based QKD, with the world’s first QKD satellite network coming in the next few years (which I believe will also be operated by China Telecom).

Industrialization in Quantum Sensing

In quantum sensing, the insertion of “quantum” into various pilot and industrial upgrading projects by SOEs and local governments becomes the most obvious. As seen in the table, examples are plentiful and seem to be quickly maturing.

Specific examples include high-precision NV-center magnetic field sensors (applied to magnetocardiography), quantum current sensors for ultra-high voltage lines14, or quantum gravimeters in the oil and gas industry.

Again, SOEs, such as grid operators or mining corporations, are natural partners to trial such pilots aligned with the government’s set of future industries.

There are also exciting science experiments, such as tests of general relativity and quantum-enhanced telescopes, that may soon be realized on the back of Chinese progress in quantum sensing and communication equipment.

What it means for China’s quantum companies

Importantly for China’s fledgling quantum companies, the entry of SOEs brings revenue and early demand, while the multitude of new quantum-focused GGFs brings “patient” capital. Most recently, a 51 billion CNY Central Enterprises Strategic Emerging Industries Development Special Fund was announced, backing quantum, AI, and high-end equipment as the three main investment areas.

I would expect China’s private sector quantum supply chain and full-stack quantum startups to continue growing at a rapid pace.

It is now no longer completely unusual to have multiple Chinese quantum startups announce CNY 100 million+ funding rounds in a single month.

For example, QBoson (玻色量子, photonic quantum computing) and CIQTEK (国仪量子, mainly quantum sensing) both recently raised funding rounds of over CNY 100 million. New players continue to enter the field, such as two Hangzhou-based companies MatriQ (neutral atoms quantum computing, seed round), Logical Qbit (逻辑比特, superconducting quantum computing, CNY 10s of millions, Pre-A round), or e-Spin (磁性量子, seed round, electron-spin based quantum computing … or quantum-inspired computing?).

While QuantumCTek (国盾量子) remains the only publicly listed pure-quantum company in China, Hefei’s other two big quantum champions — CIQTEK (国仪量子) and Origin Quantum (本源量子) — are also expected to go public in the not-too-distant future.

With all this activity, I wonder how long it will take until some of these companies offer products at a meaningful scale that combine real quantum advantage (for some eventual end user) with profitability. Until then, as elsewhere in the world, the sector will heavily rely on government money, be it through research funding, subsidies & tax breaks, GGFs, or SOE and government purchases.

Having discussed China’s ambitions and flurry of activity to build a future quantum industry, what are the hurdles? After all, many leading quantum institutes and companies in China are on the US entity list, US investments are nearly completely barred, and, under the Biden administration, the US coordinated sweeping export controls on the quantum supply chain together with allied countries.

Let’s revisit quantum export controls and the Chinese struggle for self-sufficiency.

3) Export controls and self-reliance

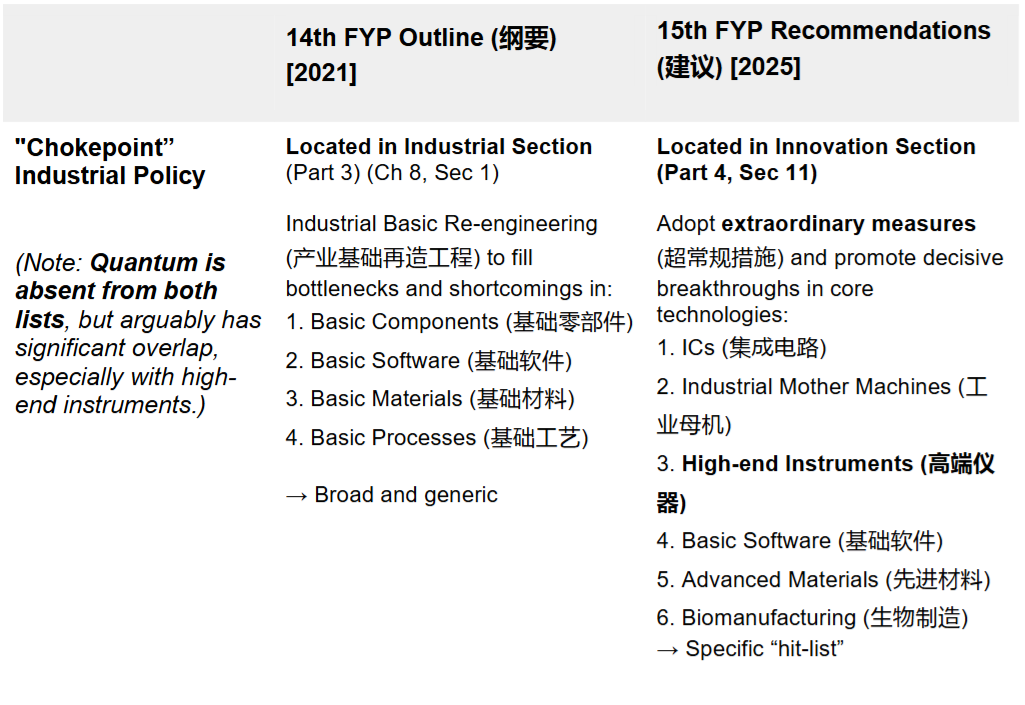

Overcoming industrial and technological chokepoints, phrased as self-reliance and self-strengthening (自立自强), still plays a very prominent role in the FYP15 recommendations.

The FYP15 recommendations are more concrete than FYP14 and provide a specific “hit-list” of six areas slanted for decisive breakthroughs: Semiconductors, foundational machine tools, high-end instruments, basic software, advanced materials, and biomanufacturing15 — with high-end instruments most relevant to quantum technologies.

“Extraordinary measures” shall be adopted to achieve these decisive breakthroughs; what this means concretely remains to be seen, but the strong language has experts worried.

Notably, quantum technologies do not feature separately in this list, despite significant escalations of Western restrictions over the last years, which escalated in 2024, with broad entity list additions, outbound investment restrictions, and the addition of quantum computers and related equipment to the US Commerce Control List in coordination with allies.

Can we conclude from the absence of quantum technologies in the “hit-list” that the quantum restrictions are not a major concern and hence have not been effective? There are a few examples one could make to support this view:

Steady cadence of self-reliant hardware announcements, often claimed (although this should be taken with a grain of salt) to be internationally competitive: Dilution refrigerators (at least 7 companies by this point), control electronics (1, 2, 3), lasers (1), interconnects (1), (superconducting) quantum chip production (1), photon detectors (1), etc.

Continuance of impressive technical achievements in spite of the escalation of Western restrictions around 2024. For example, the USTC/National Quantum Lab superconducting quantum computing group recently caught up to Google’s Willow chip below-threshold error correction breakthrough, all despite having to develop their own dilution refrigerator and control electronics due to export controls!

Ambitious targets: While some of the more concrete project competitions (e.g., those issued by the National Lab) are unfortunately no longer to be made public, the targets that I have seen remain highly ambitious. Take for example the 17 quantum challenges16 issued by the Ministry of Industry and Information Technology earlier this year. By 2026, they ask for:

Control electronics for >1000 qubits

dilution refrigerators with cooling power ≥3000 μW at 100 mK

quantum error correction with surface code distance ≥5/color code ≥3 (which has already been surpassed with distance 7 surface code by both Google and Zhu Xiaobo’s group)

quantum OS supporting ≥4 hardware types and ≥2000 qubits

carbon-monitoring quantum lidar with ≥2km range

portable quantum gravimeter

…

… — while I am no expert on the technicalities of these challenges, the specific and quantified targets do signal confidence to contribute to the very frontier of the field, all despite lacking access to big parts of the Western quantum supply chain.

Generally, it is indeed my view that there are no durable Western chokepoints over China in quantum technologies and that restrictions have only caused temporary complications, at the cost of accelerating the emergence of a truly self-reliant quantum supply chain in China.

I have written about export controls in the past, arguing that they will not be effective beyond a decade, mainly due to the early development status of quantum and, compared to semiconductors, internationally dispersed supply chain, as well as the long advance-signalling of impending quantum controls. These controls have slowed Chinese efforts in the short term, at the “cost” of bringing the users on board with Chinese localization efforts: Leading laboratories and quantum start-ups have no choice but to rapidly iterate with domestic suppliers in replacing foreign dependencies. Given the long timelines until quantum technologies are useful, choosing short-term disruption over long-term acceleration is a much dumber strategy in quantum than in AI.

Export controls also significantly contribute to the risk of a broader “bifurcation” in quantum technologies.

That said, I do not think China’s transition to a fully self-reliant quantum supply chain is complete. There are remaining dependencies, and they probably nearly all fall (with exceptions in some material inputs, such as Helium-3) under the High-end Instruments (高端仪器) category of the “hit-list.” In addition to import dependencies, the international isolation of China’s quantum sector also has other negative consequences, such as market access and research partnerships.

Removing foreign dependencies and relying on domestic alternatives in the enabling “picks and shovels” to build quantum tech likely remain among the highest priorities for China’s quantum planners. However, on the downstream end, I would expect fewer worries about export controls on full-stack quantum computers or their cloud access. Instead, in the FYP recommendations, these endproducts, downstream applications, and user platforms are part of the “offensive future industry list,” not the “defensive self-reliance hit-list.”

4) What does all this mean outside of China?

As Chinese quantum cloud platforms and user communities mature, as more and more industrial applications are tried, and as previously low ARL start-ups market more standardized quantum products, what does this mean for the internationalization of China’s quantum industry?

Internationalization vs Insularity

I believe the period of FYP15 will see a stronger push of China’s quantum industry abroad. I have elaborated reasons for this before: Hone the global competitiveness of local champions, shape global standards, and capture the economic value of this future industry. Intensifying domestic competition adds to the push abroad.

The doubling down on framing quantum as a Future Industry, rather than (at least publicly) first and foremost as a national security-driven race for fault-tolerant quantum computing, strengthens my belief that high-value exports of quantum components will be encouraged, with limited export controls.

Further, I expect that international engagement in quantum will become more deliberate. This will likely include (continued) support for attracting talent from abroad and engaging in research collaborations, as well as China-based international quantum conferences, quantum hackathons, or other quantum exchange activities.

Beyond such exchange activities, expect to see a more deliberate effort to shape the global quantum industry and its standards, gain market share, and establish a favorable foothold in the future quantum value chain.

This may not be surprising to “China watchers” who see similar developments in more mature industries.

However, I am not sure how many people in the Western quantum ecosystem see this coming, given how locked out Chinese quantum companies appear from the quantum industry taking shape in Europe and the US.

The expectation that China’s relative isolation will continue is likely reinforced by the common characterization of China’s quantum ecosystem as insular and secretive. As I elaborated in the introduction of this blog, I have a more nuanced view. I partially agree with this characterization, given limited transparency on implementation and funding details of national quantum programs, increased geo-blocking of relevant websites (limiting access from outside China), and the deepening focus on self-reliance and competition with America.

At the same time, many leading quantum research institutes in China remain very open to international collaborations, actively hire foreigners, and even have dedicated budgets for internationalization. I have always found Chinese quantum researchers very willing to share details about their work and go out of their way to accommodate language barriers.

Of course, China is big, and international openness surely differs by institute, with some groups rumored to hire exclusively Chinese, but my overall impression is that the “internationalization drive” often still outweighs the “securitization drive” that has become so defining in Europe and the US.

Chinese quantum export controls are much more limited than in the US and Europe. Anecdotally, you can already find examples of Chinese quantum exports. This includes upstream exports to Western countries (e.g. lasers) and more prominent quantum computing exports to the Middle East, Pakistan, South East Asia, Russia, and BRI countries more broadly.

In addition to Chinese quantum exports, I wouldn’t be surprised if we hear of some foreign investments (e.g., from the Middle East) into China’s quantum sector during FYP15. After all, foreign quantum investments are officially encouraged by MOFCOM, and China’s commercial quantum sector is rapidly growing.

Beyond anecdotal evidence, I find it hard to say how successful China’s quantum internationalization will be in FYP15. I think the latest point when it will happen is once economic forces come into play as quantum becomes a “real industry” (not a future industry) with demonstrated practical applications, including for more “China-friendly” BRI and Global South countries.

So maybe we have to wait until FYP16? I don’t know, but I speculate it may be faster.

A lot of the current relative isolation of China in quantum technologies is due to concerted pressure from the Biden administration, largely getting European countries and other international partners on board with quantum export controls. As Washington deemphasizes multilateral approaches and Europe starts to derisk not just from Chinese, but also (albeit to a lesser extent) American quantum dependencies, the “quantum embargo” on China might soften over the next few years.

Are we setting the scene for a “Second China Shock”?

With Chinese policy makers laser-focused on technological upgrading and building the industries of the future, some are warning of a “Second China Shock”17. The first China Shock refers to the loss of manufacturing in the West following China’s reform and opening up period; the second China Shock refers to China contesting the innovative and high-value sectors that power advanced Western economies. The consequences to Western economies and security underpinnings could be devastating.

In quantum, however, these consequences are not (yet) imminent. On the commercial front, Chinese players are largely walled off from the Western ecosystem by export controls, visa restrictions, and political interventions that ensure few partnerships take place.

I worry what this looming bifurcation means for the sector going forward.

At the same time, I worry what it means for the West if this artificial divide crumbles under the pressure of international market competition. Are Western quantum start-ups and supply chain SMEs ready to compete with and, in some cases, rapidly adapt and learn from a Chinese quantum ecosystem they currently wouldn’t touch with a ten-foot pole? By treating China as a “no-go” zone to avoid political backlash, are they missing out on critical market intelligence and innovation partnerships?

Will Western policymakers be able to grapple with an ecosystem that turns out different from what they always told themselves? Will Western policymakers eventually realize that their walls succeeded in protecting IP, only to fail at capturing the market?

The answers will determine whether China Shock 2.0 eventually hits the quantum sector.

Link to a useful explainer of New Quality Productive Forces.

To understand what quantum is in China’s plans, it helps to understand what it isn’t (yet).

What it is not: Quantum is not (yet) a Strategic Emerging Industry

Strategic Emerging Industries (SEIs) are the key pillars of China’s economic transition to a new model. These industries are already emerging and have a clear path to realizing real productivity gains and economic impact. They are all “high-tech” and hence high-value-add. While FYP14 specified nine concrete areas, the FYP15 recommendations list four clusters: New Energy, New Materials, Aerospace, and the Low-Altitude Economy. The “three new” that already drive massive export growth in China–new energy vehicles (NEVs), lithium-ion batteries, and PV cells–fall into these clusters.

Quantum technology clearly does not belong to this category: It is not yet a sector of the real economy that noticeably drives growth. Rather, it is a Future Industry, the foundations of which are currently being laid across the world thanks to generous government spending and VC support.

Coincidentally, around the time the FYP15 recommendations were issued, the Hefei National Lab also issued its 2025 project guidelines for the open competition projects under the Sci-Tech Innovation 2030 Quantum megaproject. Unfortunately, these are not to be reproduced publicly.

To achieve NQPF, the FYP15 recommendations call for deeper integration with China’s industrial modernization drive. Both self-reliance and integration were not absent in FYP14. However, in FYP14, integration was primarily targeted at integration across S&T actors; integration with industrial innovation was only emphasized for enterprise innovation.

The FYP15 recommendations on the other hand call to integrate whole ecosystems, not just individual actors. This includes both the “deep integration of scientific and technological innovation and industrial innovation” as well as the 3-to-1 integration of education, S&T, and talent.

“Implementation Opinions on Accelerating Scenario Cultivation and Opening to Promote Large-Scale Application of New Scenarios” (关于加快场景培育和开放推动新场景大规模应用的实施意见)

Which again is the local implementation of a national policy tool, 揭榜挂帅. Under the same framework, national challenges were posted by the Ministry of Industry and Information Technology, see the section on export controls below.

Notice from the General Office of the Ministry of Industry and Information Technology on Further Accelerating the Systematic Layout and High-Level Construction of Pilot-Scale Platforms in the Manufacturing Industry (工业和信息化部办公厅关于进一步加快制造业中试平台体系化布局和高水平建设的通知)

“Focusing on key industry sectors related to future development, industrial security, and a shortage of pilot-scale production capacity, such as artificial intelligence, humanoid robots, quantum technology, clean and low-carbon hydrogen, biomedicine, industrial machine tools, instrumentation, major technical equipment, new materials, and information technology”

Published by the National Information Technology Standardization Technical Committee’s Quantum Information Standards Working Group. A summary can be found here (with instructions on how to obtain the whole >100 pages document).

Under the same 揭榜挂帅 framework discussed in the section on Hefei’s push for quantum applications.

I remember when seeing this in a museum in Hefei; my first reaction was: “Why quantum?” Turns out, there may be valid reasons related to the stability of magnetometers based on NV-centers and the ability to read them out optically (avoiding wiring close to high-voltage lines, which would require a lot of isolation).

Under the 揭榜挂帅 format, something like “Adopt the Challenge, Appoint the Leader” or also sometimes called “bounty-system.” I think it roughly works as follows: Government / industry formulates open challenges, organizations can apply to solve these challenges out of which up to five organizations are shortlisted. After two years, the results achieved are evaluated and winners selected.

Shoutout to Trivium for their excellent discussion of this in their recent podcast.

The assumptions made here are bassakwards. Computer processor chips over time use smaller and smaller sized transistors. As the transistor size goes down and and the binary voltage goes down, power decreases over the years. Today’s processors have multiple cores on one chip and the main factor in energy consumption is how the software utilizes all those cores. What we attempt to compute today is far more than in the past. Power for CPUs are limited by the size and thermal path away from the active layer. This puts all chips in roughly the same energy limit. Most chips are less than an inch square and the fan that you clip onto the chip can only do so much cooling via the thermal grease. The energy used is more about how many CPUs a data center is running and the AC units used to cool all those computers back down closer to room temperature. The environment will be fine if we stop polluting with our gasoline or diesel cars and comically oversized pickup trucks. The data center pollution could also include the IT guy’s drive to work in his beater.